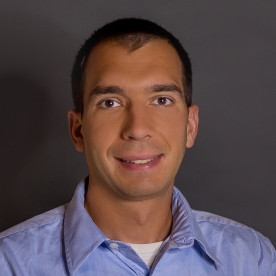

Our Estate Planning attorneys have earned the confidence of generations of clients by meeting their needs with skill and sensitivity.

With decades of experience in trust and estate counseling, our knowledgeable team guides clients through sophisticated estate and philanthropic planning and asset protection plans that focus on our client’s long-term goals for their families, businesses, and other assets.

We account for complex federal and state tax laws as they relate to family businesses, charitable giving, and generational wealth preservation with each and every client. We’ll weigh the best tools for each individual and family, including the creation of various types of trusts that maximize wealth and minimize taxation issues, including GRATs, ILITs, QPRTs, dynasty trusts, Ohio Legacy Trusts, and more.

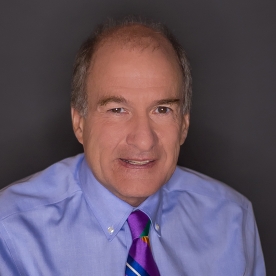

Most of our attorneys have more than 20 years of experience in estate planning and several are Ohio State Bar Association Certified Specialists in Estate Planning, Trust and Probate Law. Good wealth management and estate plans help individuals and families with some of their most important concerns. We’re here to seek out the best strategies to avoid the probate process, avoid unnecessary taxes, and simplify transitions during difficult times.