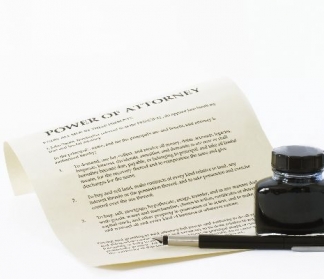

With attorneys certified as Estate Planning, Trust, and Probate Law Specialists by the Ohio State Bar Association as part of our team, Critchfield is ready to meet the important family and business needs of our clients as they consider the future distribution of their assets after death.

We also provide services related to other life events such as Family and Private Trust Companies, Pre-Nuptial Agreements, and Private Adoptions.

Our range of capabilities is broad and includes:

- Counsel in planning and administration of estates, trusts, and guardianships

- Advise clients on options to avoid probate

- Represent fiduciaries and beneficiaries of estates, trusts, and guardianships

- Advise individual and corporate trustees concerning their fiduciary duties and obligations

- Advise fiduciaries and beneficiaries on numerous options and post-death planning opportunities

- Prepare and review federal and state estate tax returns and federal gift tax returns

- Advise fiduciaries on estate income-tax related issues, estate-tax, and generation-skipping-transfer-tax issues, and various elections that may be available

- Represent estates in federal and state estate-tax audits and disputes (including appeals)

- Assist clients with the proper funding of trusts and advise clients on the income-tax issues of funding trusts

- Represent and advise clients in various phases of probate and trust litigation (including construing and reforming the terms of wills and trusts, prosecuting will-contest actions, and the removal of fiduciaries)